Magic: the Gathering’s latest expansion, Outlaws of Thunder Junction, has had the community abuzz. A set with a huge step-up in power, two bonus sheets, an already-beloved limited format, and an expansion that’s had some serious hits and misses from the creative side, OTJ occupies an interesting place in the world of Magic. But how has that complicated response translated into sales?

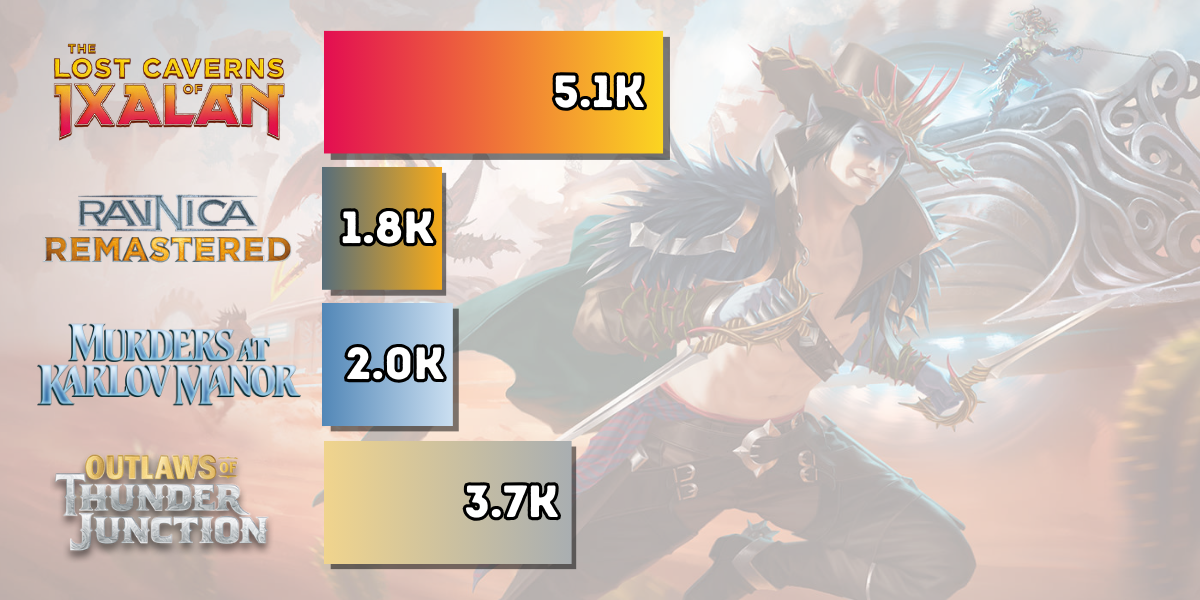

Using third-party tracking tools, the team at Cardboard by the Numbers has pulled estimates for Amazon pre-order sales for the last few booster-based expansions for the month prior to street date to try to understand this question in a comparable way. Here, you’ll see the estimated sales for non-Collector booster boxes of the last ten expansions:

The most immediate takeaway is the drop-off starting in 2024 with Ravnica Remastered and continuing through each expansion of the year. While I don’t want to speculate too much on Hasbro’s earnings call slated for next week, I would imagine that, based on this, it’s going to be the biggest WotC revenue decline in recent memory.

But why is that? Generally, the Magic community has been fairly negative about Murders of Karlov Manor and to a lesser extent, Outlaws of Thunder Junction. The numbers here represent trends shared from LGS owners reasonably well, as well as overall exuberance with the state of Magic from players. While I think Thunder Junction has a lot going for it and its reputation will come around once people play with the cards or draft the set a few times, it did not surprise me to see it the second lowest of premiere expansions since the start of 2023.

I think any conclusions drawn about Play Boosters are too early, and there are simply too many conflating factors that could lead to the sales dip timed with their release. The new primary product for each expansion, Play Boosters combine Set and Draft boosters in both gameplay function and their niche within the game store ecosystem, letting owners cut down on SKUs and consumers cut down on confusion — at least theoretically, in a world in which boosters did not contain three expansion symbols within and double that number of card styles, as is the case with OTJ.

Another small thing of interest is the incredibly broad player interest for Phyrexia: All Will Be One as represented by its first place performance on this metric. Hasbro CEO Chris Cocks has said that they expected The Lord of the Rings: Tales from Middle Earth to have a longer tail and appeal to non-core MtG players, both of which do something to explain why LTR undersold Phyrexia in the pre-sale period. This demand for Phyrexia as a world — a demand not justified by power level or new card styles compared to the sets around it — underscores how unfortunate it is for WotC to have killed off the Praetors and New Phyrexia as a whole just one expansion later.

This relative spike is also interesting to see how much Magic has come to diversify its revenue streams in just the last few years. Mark Rosewater has said Kamigawa: Neon Dynasty is the best-selling premiere set of all time, followed by Strixhaven. If that’s the case, performance like we see from Phyrexia: All Will Be One would have been more the norm in years past, and yet 2023 was Magic’s biggest year to date, revenue wise. The myriad auxiliary products have helped ensure that misses like March of the Machine: The Aftermath are not enough to prevent the game’s continued growth.

As we mentioned the last time we used Amazon data to try to understand the larger Magic ecosystem, we want to be clear: Amazon is not a major outlet for the sales of sealed booster boxes. If each of the 6,000+ local game stores pre-ordered only two cases of booster boxes per set, Amazon’s volume would account for only 11% at most of all sealed box sales, and that’s pretending other outlets did not exist. While the smallest stores may only order a case or two, the outliers more than make that average an intensely conservative one. From our previous analysis, we estimate Amazon accounts for between 5 and 10% of total sealed revenue on the typical expansion, with 5% being closer to the norm for a non-UB expansion. And while this data jives with our anecdotal experiences listening to LGS owners, I would caution folks not to treat this as scripture.

That said, I hope you found it interesting and helped you understand the role Outlaws of Thunder Junction plays in the world of Magic, and gave hints into its early reception. Thanks so much for reading! We have new Magic: the Gathering infographics and analysis nearly every week, so if you’ve enjoyed this article, sign up for our newsletter and be sure to follow us on Facebook, Instagram, Twitter, and Threads!!

Miles Atherton is the editor-in-chief of “Cardboard by the Numbers” and has been playing Magic since 2006. Since studying Agricultural Economics at UC Davis, he’s built a career as an award-winning marketing executive in the entertainment industry with a love of data journalism and now consulting for White Box Entertainment. He’s also written for Anime Trending, Anime Buscience, Anime News Network, and Crunchyroll News, serving as Executive Editor of the latter from 2016 to 2021.

Leave a Reply